Our STORY

REALITY Equity Funds acquire, develop, and manage strategic properties that positively impact the Israeli

real estate landscape.

We master identifying unique assets with significant value-add potential, repurposing white elephants, rezoning land use, and enhancing operational performance, ultimately maximizing their value and returns.

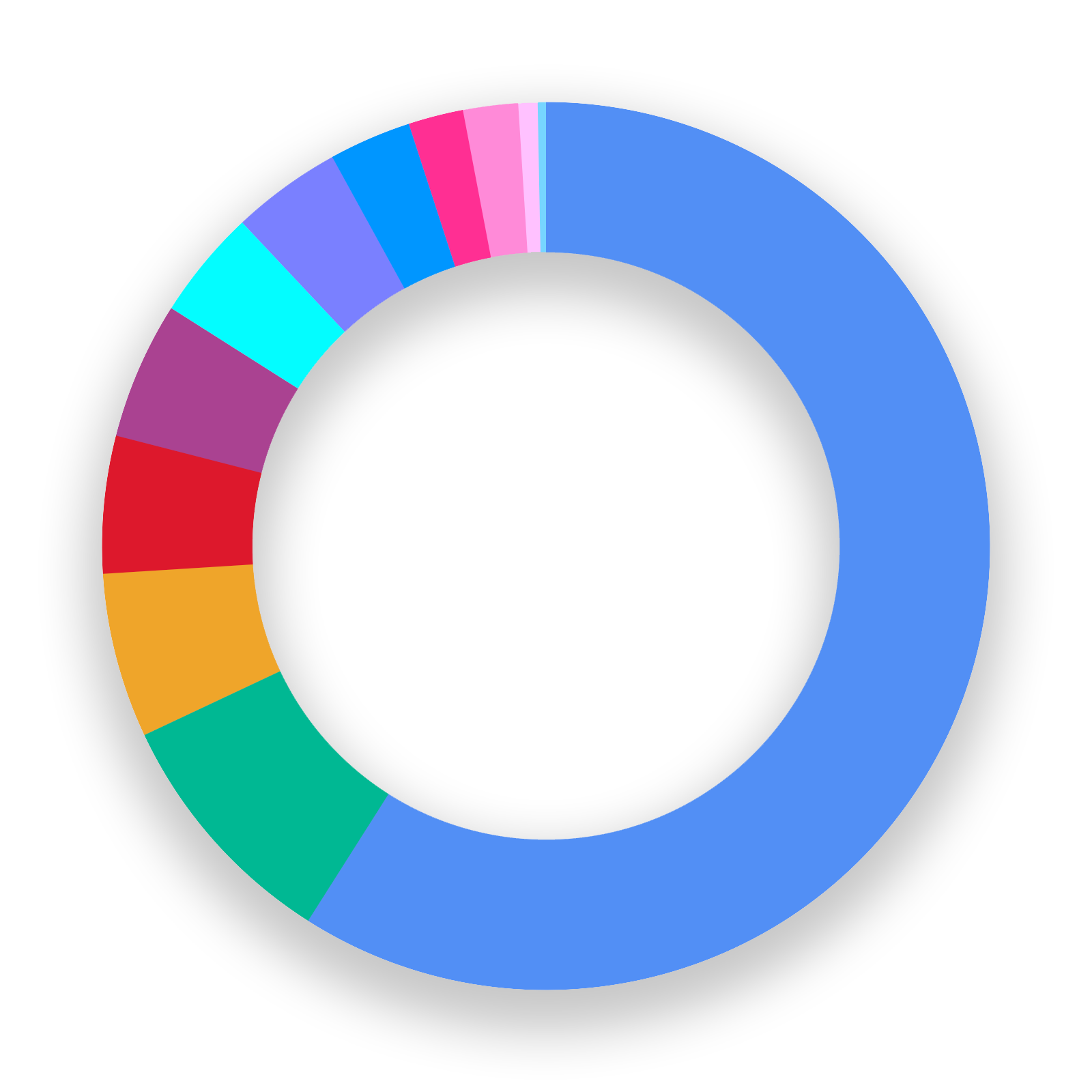

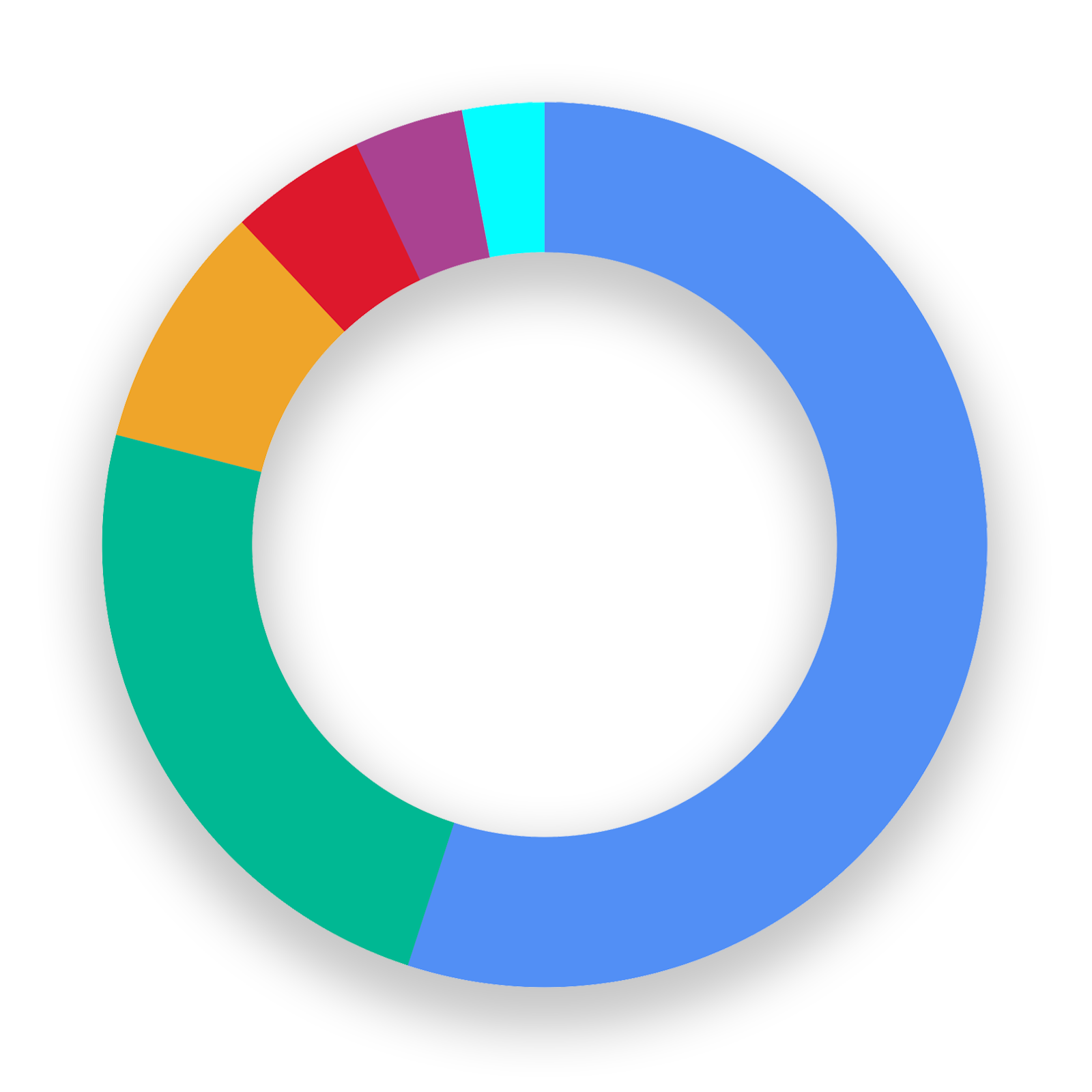

Our diversified portfolios cover all real estate sectors in Israel, including residential, commercial, offices, industrial, logistics, hospitality, public spaces, and mixed-use properties nationwide.

With its close collaboration with national and local governments and consistent performance, REALITY is positioned as one of the key drivers of Israeli real estate supply and value.